About

Klapton Reinsurance

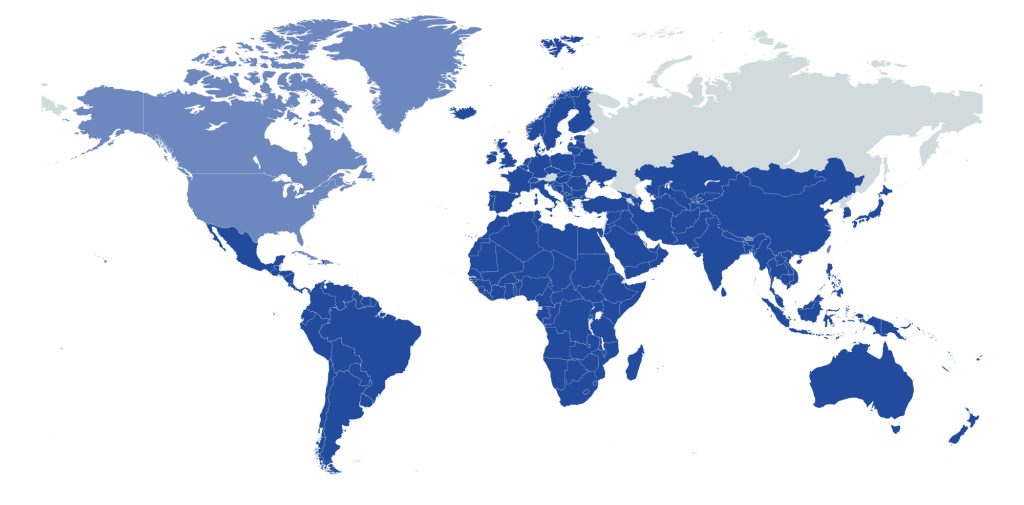

Klapton Reinsurance Limited (“Klapton Re”), which is rated by Moody’s Investor Services, was incorporated in Zambia to provide reinsurance services to complement other insurers and reinsurers in Zambia, Africa, the Middle East and beyond.

The company was established in Zambia after identifying the need to provide local reinsurance support and has positioned itself for regional engagements and related business investments.

Klapton Re employs local people and increases the local industry’s financial capacity to retain more risk locally. Our uniqueness is the strategic linkage with an existing network of regional brokerage hubs that support the Zambian operation by bringing in a global reinsurance business. It is of significant value to the Zambian market as it attracts liquidity in the market.

Klapton provides quality solutions to our customers, brokers, insureds, and re-insureds with a wide range of insurance and reinsurance products.

Our business model focuses on core activity lines, commercial (SME, Contractors & Engineering) and inward facultative reinsurance covers. These covers are carefully accepted by customers and brokers with whom we develop long term relationships.

Klapton Re receives direct placements from local, regional, and international insurance companies and reinsurance brokers with our head office in Lusaka. Klapton Re also maintains a presence in Africa via its regional hubs.

Established

Consolidated Total Equity

December 2024

GWP

December 2024

Here when you need us

Why Klapton Re

We are providing reinsurance services with specific application of experience, knowledge through innovative underwriting and prudent risk management for the ultimate benefit of our customers.

Our values guide the way we do things to ensure we fulfil our vision, mission and objectives:

Knowledge

We will promote the acquisition and optimisation of knowledge. Klapton Re will be a learning and data-driven organisation and strive to be a centre of relevant knowledge.

Long Term

We will endeavour to take a long term approach to the decisions we make.

Accountability

Our commitment is to be transparent and be accountable in all our actions and decisions. We will promote corporate governance at all times.

Proactivity

We will endeavour to meet and exceed our client needs by embracing innovation proactively.

Togetherness

We will collaborate with our stakeholders in the value chain, beginning with our employees, insurers, customers, shareholders, regulators, and the public.

Our Vision

To be a preferred provider of reinsurance services in our chosen markets.

Our Mission

To provide reinsurance services with specific application of experience, knowledge through innovative underwriting and prudent risk management for the ultimate benefit of our customers.